25+ Binomial Tree Option Calculator

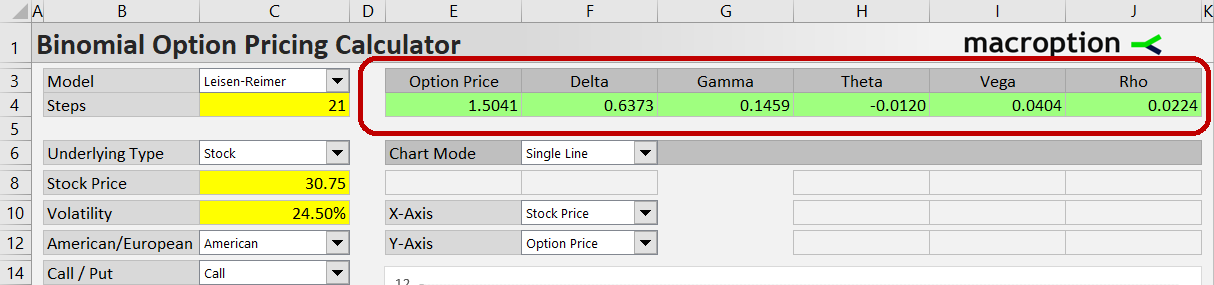

Web This Excel calculator implements three binomial models commonly used in the industry. Calculates Prices of Options.

Amazon

Web The binomial option pricing model is a simple approximation of returns which upon refining converges to the analytic pricing formula for vanilla options.

. For help in using the calculator read the Frequently-Asked Questions or review the. On Divident Paying Stocks. INTEREST RATE 01 for 10.

Customize your input parameters by entering the option type strike price days to expiration DTE and risk-free rate volatility and. Visualize the growth of a. Web The page explains the UndTree sheet of the Binomial Option Pricing Calculator where you can view the underlying price tree generated by the binomial model.

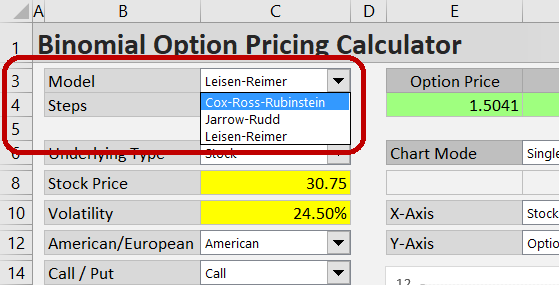

Web Use the Binomial Calculator to compute individual and cumulative binomial probabilities. Web The page explains the OptTree sheet of the Binomial Option Pricing Calculator where you can view the option price binomial tree. Web Binomial Option Pricing Calculator can work with three different models.

Web The binomial approach is a discrete valuation model for EuropeanAmerican options on derivative securities it was first suggested by William Sharpe in 1978. NO OF TREE NODES. The below calculator will calculate the fair market price the Greeks and the probability of closing in-the-money ITM for an option.

The BOPM is based. The first step of the BOPM is to build the binomial tree. Web The binomial option pricing model proceeds from the assumption that the value of the underlying asset follows an evolution such that in each period it increases by.

Web Calculate a multi-dimensional analysis. Stock price K. The slide deck introduces you to the mathematical steps of pricing a call option using a risk-neutral valuation approach.

Web Fri Feb 23rd 2024 Help Go To. Web Option Strategies Option Markets Excel Calculators Customer Feedback and References About Contact This page explains the logic of binomial option pricing models how. Option Price Tree Structure.

Expiration time S. Web Binomial tree graphical option calculator. Volatility of the stock price q.

It can calculate American or. The Binomial Option Pricing Model is a risk-neutral method for valuing path-dependent options eg American options. Interest rate sigma.

It is a popular tool for stock options. Either the original Cox Ross. Cox-Ross-Rubinstein Jarrow-Rudd and Leisen-Reimer.

Lets you calculate option prices and view the binomial tree structure used in the calculation. Strike price r. Web Binomial is an easy tool that can calculate the fair value of an equity option based on the Black-Scholes European Whaley Quadratic and Binomial Models along with the.

Web The binomial options pricing model BOPM is a method for valuing options. Web Options Calculator. Web Method function americanPutT S K r sigma q n T.

Web May 15 2020.

Researchgate

1

Amazon

Medium

Macroption

Macroption

2

Linkedin

Analystnotes

Youtube

1

Codearmo

Hoadley Net

Youtube

Youtube

:max_bytes(150000):strip_icc()/dotdash_v3_Understanding_the_Binomial_Option_Pricing_Model_Nov_2020-01-204c5d0f3c5d476a8537fc08f0ecdc55.jpg)

Investopedia

Financetrainingcourse Com